Subscriber Savings Account

Branch's Subscriber Savings Account Policy

BRANCH INSURANCE EXCHANGE

SUBSCRIBER SAVINGS ACCOUNT POLICY

Branch Insurance Exchange (“BRANCH”) is an unincorporated association of Subscribers operating as an insurer through a Subscriber Agreement and Power of Attorney (the “Agreement”), which all Subscribers are required to sign. In the Agreement, the Subscribers designate Branch Financial, Inc. (“BFI”), a for profit entity, to be the Attorney-in-Fact for BRANCH. As Attorney-in-Fact, BFI manages all insurance operations for BRANCH Subscribers. One benefit of being a BRANCH Subscriber is a Subscriber Savings Account (“SSA”), which BFI maintains pursuant to this Subscriber Savings Account Policy (the “SSA Policy”).

The key provisions of the SSA Policy are as follows:

Subscriber Savings Accounts (SSAs): SSAs are notional accounts held for each active BRANCH Subscriber. Funds allocated to SSAs remain on BRANCH’s balance sheet and are available as part of its overall claims paying ability. BFI may choose to fund SSAs as described below.

SSA Funding: BFI may, in its discretion, make contributions to SSAs known as “SSA Grants.” SSA Grants, if any, will be made according to the following terms:

(a) SSA Grants, if any, will be made at time intervals as may be decided solely by BFI.

(b) SSA Grants, if any, are based on BRANCH’s overall results, and not the results of any individual Subscriber. SSA Grants may also be subject to regulatory approval when applicable;

(c) Until the time of vesting as may be allowed according to the terms of this SSA Policy, funds held in an SSA are considered surplus, and BFI is authorized to use any and all of these surplus funds to pay any unsatisfied obligations; and

(d) SSA funds do not include interest earned on SSA funds or any other funds.

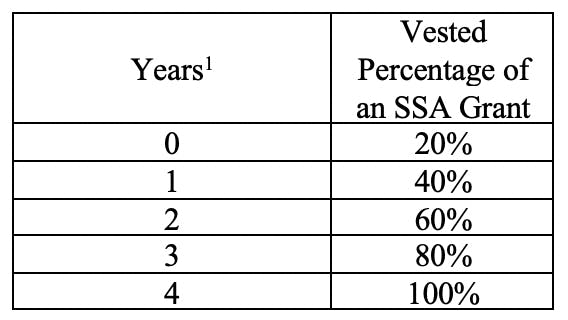

Vesting Schedule: Each SSA Grant becomes vested according to this schedule:

SSA Distributions: Once funds are vested, current Subscribers may request a cash distribution up to the amount of funds in which they are vested. Subject to all limitations contained herein, terminated Subscribers will automatically receive a distribution of all SSA funds in which they are vested upon leaving BRANCH. For details regarding how to request a distribution, please see [insert URL].

Limitations on Distributions to Terminated Subscribers: No distribution of any unvested SSA funds will be made to a terminated Subscriber.

Amendment: The SSA may be amended at any time by BFI, subject to legal and regulatory approval where required. A current version of the SSA Policy can be reviewed at members.ourbranch.com.

[1] For purposes of this SSA Policy, “Years” means consecutive twelve-month periods of time starting on the date of an SSA Grant while at least one BRANCH policy remains in force without any lapse in coverage.